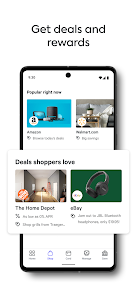

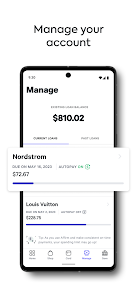

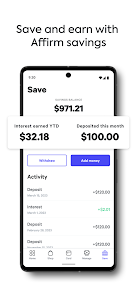

Screenshots

Related Apps

![]()

My Prediction Future Wedding

![]()

ToonApp: Cartoon Photo Editor

![]()

Prank Call & Funny Video

![]()

Wedding Dress AI

![]()

iHeart: Music, Radio, Podcasts

![]()

EVA AI Chat Bot & Soulmate

![]()

Fingerprint Scanner Personalit

![]()

Face Mashup Challenge

![]()

Palm Secret - Aging&Cartoon

![]()

Linky AI: Chat, Play, Connect

![]()

Zodiac & Horoscope: CosmicVibe

![]()

DaVinci - AI Image Generator

![]()

Cut Paste Photo Seamless Edit

![]()

ParkMobile: Park. Pay. Go.

![]()

Genral Tv | Video Player

About this app

- NameAffirm: Buy now, pay over time

- CategoryShopping

- PriceFree

- Safety100% Safe

- DeveloperAffirm, Inc

- LabelShopping

editor reviews

Affirm is a financial services app designed to help you split purchases into manageable payments over time. It's a buy now, pay later (BNPL) service that lets you shop at thousands of online and in-store retailers without using a traditional credit card. Launched in 2012, Affirm is available for download on both Google Play and the App Store. It has been installed by millions of users. The app itself is completely free to download and install. You don't need to pay anything to get the app on your phone. Registration is required to use the service; you'll need to provide some basic information so Affirm can perform a soft credit check, which doesn't hurt your credit score. There are no hidden fees, late fees, or compounding interest with Affirm. The app makes money by charging merchants a fee, not you. You might see ads or promotions for specific stores within the app, but there are no disruptive video ads or pop-ups.

Using Affirm is pretty straightforward. When you're ready to check out at a supported store online, you just select Affirm as your payment method. The app will quickly show you your payment options—like paying in 4 interest-free installments every two weeks, or a longer plan with interest. You pick the plan that works for your budget, confirm the details, and that's it. The purchase is approved instantly. The app then keeps track of all your loans in one place. My tip is to always check the payment schedule before you confirm. The app sends reminders before each payment is due, which is super helpful. You can also pay off your balance early anytime without any penalty, which is a great feature if you come into some extra money.

Compared to other buy now, pay later apps like Afterpay or Klarna, I prefer Affirm for a few reasons. The biggest thing is transparency. With Affirm, you know the exact total cost and schedule before you commit—no surprises. Some other services can be less clear. Also, Affirm reports your payment history to credit bureaus, which can actually help you build credit if you pay on time, whereas many competitors don't do that. While Afterpay is great for smaller, frequent purchases, Affirm often offers higher spending limits and longer terms for bigger buys like electronics or furniture. It feels more substantial and integrated directly into many major retailers' checkout processes, making the whole download and install experience seamless.

features

- 🔍 Transparent Financing: Before you confirm any purchase, Affirm clearly shows your payment schedule, the total amount you'll pay, and any interest. There are no hidden fees or compounding interest, which is much clearer than some credit card statements.

- 🔍 Flexible Payment Plans: The app offers a variety of plans at checkout. You might get 4 interest-free payments, or a 6, 12, or even 24-month plan. This flexibility for different budget needs sets it apart from more rigid installment apps.

- 🔍 Credit Building Potential: Responsible use of Affirm can help build your credit, as they report payment history to credit bureaus. Many similar BNPL apps don't offer this feature, making Affirm a more strategic financial tool.

- 🔍 Wide Merchant Network: You can use Affirm at a huge range of stores, from big names like Walmart and Amazon to direct-to-consumer brands. This widespread acceptance often beats the more limited networks of newer apps.

pros

- ✅ No Hidden Fees: The promise of no late fees, no compounding interest, and no hidden charges is a massive advantage over credit cards and even some other installment services that have penalty fees.

- ✅ Soft Credit Check: Applying for a loan through Affirm uses a soft inquiry that doesn't affect your credit score, which is more user-friendly than the hard pulls required for most credit cards.

- ✅ Easy Early Payoff: You can pay off your entire balance early at any time without any penalty, giving you full control. Some similar services don't emphasize or allow this as easily.

cons

- ⚠️ Not Accepted Everywhere: While growing, Affirm isn't available at every single online checkout. You still need to check if the merchant partners with them, unlike a universal credit card.

- ⚠️ Can Encourage Spending: The ease of splitting payments might lead to overspending on things you wouldn't buy with cash upfront, a common issue with all BNPL apps compared to traditional saving.

Hot Apps

Hot Games

Disclaimer

1.Apkinfast does not represent any developer, nor is it the developer of any App or game.

2.Apkinfast provide custom reviews of Apps written by our own reviewers, and detailed information of these Apps, such as developer contacts, ratings and screenshots.

3. All trademarks, registered trademarks, product names and company names or logos appearing on the site are the property of their respective owners.

4.Apkinfast abides by the federal Digital Millennium Copyright Act (DMCA) by responding to notices of alleged infringement that complies with the DMCA and other applicable laws.

5.If you are the owner or copyright representative and want to delete your information, please contact us [email protected].

6.All the information on this website is strictly observed all the terms and conditions of Google Ads Advertising policies and Google Unwanted Software policy.

7.Apkinfast.com is an independent, information-only website which is 100% free to all the users.