Snapmint: Buy Now, Pay in EMIs

ShoppingLatest APK

DownloadScreenshots

Related Apps

![]()

My Prediction Future Wedding

![]()

ToonApp: Cartoon Photo Editor

![]()

Prank Call & Funny Video

![]()

Wedding Dress AI

![]()

iHeart: Music, Radio, Podcasts

![]()

EVA AI Chat Bot & Soulmate

![]()

Fingerprint Scanner Personalit

![]()

Face Mashup Challenge

![]()

Palm Secret - Aging&Cartoon

![]()

Linky AI: Chat, Play, Connect

![]()

Zodiac & Horoscope: CosmicVibe

![]()

DaVinci - AI Image Generator

![]()

Cut Paste Photo Seamless Edit

![]()

ParkMobile: Park. Pay. Go.

![]()

Genral Tv | Video Player

About this app

- NameSnapmint: Buy Now, Pay in EMIs

- CategoryShopping

- PriceFree

- Safety100% Safe

- DeveloperSnapmint

- LabelFinance

editor reviews

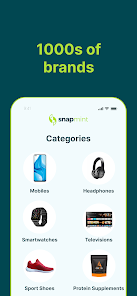

Snapmint is a shopping and finance app designed to help you buy products now and pay for them later in easy monthly installments. It's basically a 'Buy Now, Pay Later' (BNPL) service that launched to make online and in-store shopping more affordable. You can find it on Google Play and the App Store, and it has been downloaded by millions of users. The app itself is free to download and install. To start using it, you do need to register an account, which involves a quick verification process. Once set up, you can browse partner stores and select Snapmint as your payment method at checkout. The app doesn't have traditional in-app purchases for its core service, but you will see ads and promotions for various products and deals from their retail partners within the app interface.

Using Snapmint is pretty straightforward. After I downloaded and installed the app from Google Play, I signed up and went through a fast approval process. Once my limit was set, I could shop. I mostly use it for electronics. For example, when I wanted a new smartphone, I went to a partner website, added the phone to my cart, and chose Snapmint at checkout. The app split the total cost into smaller, manageable EMIs over a few months. A simple tip from a regular user: always check the EMI details before confirming. The app clearly shows your payment schedule, so you know exactly what you're committing to. I also use the app to discover deals; it often has special offers or lower-cost EMI options on specific products.

Compared to other similar apps, like Simpl or Lazypay, I find myself choosing Snapmint more often. The main reason is its wider acceptance at both big online retailers and smaller local stores, which some other apps lack. The approval process felt quicker for me, and the credit limit was reasonable right from the start. While other apps might focus only on online shopping, Snapmint's ability to generate a card for in-store purchases at partner outlets is a big plus. The interface is also less cluttered than some competitors, making it easier to track my orders and upcoming payments. For someone who wants a simple way to manage bigger purchases without a credit card, this app does the job well.

features

- 🛒 Split Purchases into EMIs: The core function is letting you buy products instantly and pay in monthly installments. Unlike some apps that only work at checkout on specific sites, Snapmint often provides a virtual card you can use more broadly.

- 🔍 Shop Across Partner Stores: You can browse and shop directly within the app or use it on external partner websites. It aggregates deals from various categories like electronics, fashion, and appliances, which is more curated than just using a standard credit line.

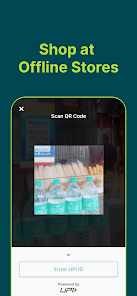

- 💳 In-Store Payment Option: A standout feature is the ability to make 'Buy Now, Pay Later' purchases in physical stores using a generated card or QR code, something not all similar finance apps offer.

- 📊 Manage Your Limit & Payments: The app clearly shows your spending limit, active loans, and payment schedule. Compared to some bank apps, the EMI tracking here is much more user-friendly and centralized.

pros

- ✅ Quick and Simple Approval: The sign-up and credit approval process is faster and requires less documentation than applying for a traditional credit card or even some other BNPL apps.

- ✅ Wide Merchant Acceptance: It works with a large network of online and offline stores, giving you more flexibility than apps tied to only one or two big platforms.

- ✅ Clear Cost Breakdown: The app is very transparent. It shows the EMI amount, tenure, and any fees upfront, with no hidden surprises at payment time.

cons

- ⚠️ Can Encourage Impulse Spending: The ease of splitting payments might lead to buying things you don't urgently need, a common issue with all 'pay later' services.

- ⚠️ Limited to Partner Merchants: You can only use it at approved stores. For spontaneous purchases at a non-partner shop, you're out of luck.

Hot Apps

Hot Games

Disclaimer

1.Apkinfast does not represent any developer, nor is it the developer of any App or game.

2.Apkinfast provide custom reviews of Apps written by our own reviewers, and detailed information of these Apps, such as developer contacts, ratings and screenshots.

3. All trademarks, registered trademarks, product names and company names or logos appearing on the site are the property of their respective owners.

4.Apkinfast abides by the federal Digital Millennium Copyright Act (DMCA) by responding to notices of alleged infringement that complies with the DMCA and other applicable laws.

5.If you are the owner or copyright representative and want to delete your information, please contact us [email protected].

6.All the information on this website is strictly observed all the terms and conditions of Google Ads Advertising policies and Google Unwanted Software policy.

7.Apkinfast.com is an independent, information-only website which is 100% free to all the users.