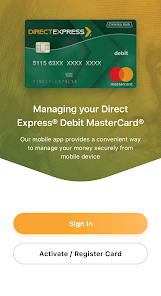

Screenshots

Related Apps

![]()

My Prediction Future Wedding

![]()

ToonApp: Cartoon Photo Editor

![]()

Prank Call & Funny Video

![]()

Wedding Dress AI

![]()

iHeart: Music, Radio, Podcasts

![]()

EVA AI Chat Bot & Soulmate

![]()

Fingerprint Scanner Personalit

![]()

Face Mashup Challenge

![]()

Palm Secret - Aging&Cartoon

![]()

Linky AI: Chat, Play, Connect

![]()

Zodiac & Horoscope: CosmicVibe

![]()

DaVinci - AI Image Generator

![]()

Cut Paste Photo Seamless Edit

![]()

ParkMobile: Park. Pay. Go.

![]()

Genral Tv | Video Player

About this app

- NameDirect Express®

- CategoryFinance

- PriceFree

- Safety100% Safe

- Developeri2c Inc.

- LabelFinance

editor reviews

Direct Express® is a prepaid debit card app designed to help you manage your federal benefit payments. It's the official app for the Direct Express® card program, which launched back in 2008 as a way for people to receive Social Security, SSI, and other government benefits without needing a traditional bank account. You can download the app for free from both Google Play and the Apple App Store. It has over a million installs on Google Play alone. There's no cost to download or install the app, and you don't need to register a new account—you just log in with your existing Direct Express® card details. The app itself is free to use for checking your balance and transaction history. It doesn't have in-app purchases, but it's important to know that the Direct Express® card program itself has certain fees for things like ATM withdrawals or replacing a card. The app might show informational messages about the card program, but it doesn't have intrusive video or banner ads popping up during use.

As a user, I use this app almost every day to keep track of my Social Security deposit. The main screen shows my current balance right away, which is a huge relief on payment days. I check my transaction history to see where my money went, which helps me budget for the month. A simple tip is to enable push notifications; that way, you get an alert the moment your benefit is deposited, so you don't have to keep opening the app to check. Another real user tip is to use the app to find in-network ATMs before you go out, to avoid extra fees. It's much simpler than calling the customer service number. I mostly use it for viewing—it's not for sending money to friends, but for managing the money that's already on my card. It's straightforward and does the job without confusing menus.

Compared to other banking or prepaid card apps like Cash App or Chime, Direct Express® is very different. It's not a full banking app; it's specifically for one card and one purpose: federal benefits. I chose it because I have to—my benefits are deposited onto this card. But the app makes dealing with that card much easier. Other apps might have more features like investing or buying stocks, but for just checking my government money, this is simpler. It's less cluttered than a big bank's app. Some similar prepaid card apps try to do too much and get complicated. This app stays focused, which is good for me and many others who just want a simple, secure way to see their benefit balance without any fuss or extra features we won't use.

features

- 🔍 Instant Balance & History: The home screen shows your available balance immediately after login. You can scroll through a clean list of recent transactions, which is much simpler than the automated phone system.

- 🔍 Fee-Free ATM Locator: The app has a built-in tool to find surcharge-free ATMs in the MoneyPass® network. This is a standout compared to just using Google Maps, as it directly helps avoid the card's withdrawal fees.

- 🔍 Deposit Alerts & Notifications: You can enable push notifications to get an alert as soon as your federal benefit payment is deposited. This specific feature is more direct and reliable for benefit recipients than general bank app alerts.

- 🔍 Card Management Tools: You can use the app to temporarily lock your card if it's misplaced and request a replacement. For its specific purpose, this integrated control is more straightforward than calling customer service for these tasks.

pros

- 👍 Perfect for its Single Purpose: It excels at providing fast, secure access to your Direct Express® card balance and history. Compared to bulky banking apps, it launches and loads information very quickly.

- 👍 Simplified for Benefit Recipients: The interface is large, clear, and easy to navigate, which is great for users who may not be tech-savvy. It avoids the complex menus of apps like Cash App.

- 👍 Reliable Payment Notifications: The deposit alerts are incredibly accurate and timely, giving peace of mind on payment days. Many full-service bank apps aren't as consistently immediate with government deposits.

cons

- 📈 Limited Functionality: You can't transfer funds to other people or bank accounts within the app. Other prepaid apps like Netspend allow P2P transfers, which would be a useful addition.

- 📈 Basic Design: The app's design feels outdated compared to modern fintech apps. Adding features like spending insights or categorization would help with budgeting.

Hot Apps

Hot Games

Disclaimer

1.Apkinfast does not represent any developer, nor is it the developer of any App or game.

2.Apkinfast provide custom reviews of Apps written by our own reviewers, and detailed information of these Apps, such as developer contacts, ratings and screenshots.

3. All trademarks, registered trademarks, product names and company names or logos appearing on the site are the property of their respective owners.

4.Apkinfast abides by the federal Digital Millennium Copyright Act (DMCA) by responding to notices of alleged infringement that complies with the DMCA and other applicable laws.

5.If you are the owner or copyright representative and want to delete your information, please contact us [email protected].

6.All the information on this website is strictly observed all the terms and conditions of Google Ads Advertising policies and Google Unwanted Software policy.

7.Apkinfast.com is an independent, information-only website which is 100% free to all the users.